Prior to the holidays, I had shared Part I of #InvestInYourPeopleMKE. The story had the flair of college days – the crazy side hustles many students pursue to make the rent and pay for tuition. However, within it, it also showcased the concept of confluence in making decisions and its importance in creating outsized results.

So how do we tie that tale to what is happening today in Milwaukee? Let’s get crackin’!

THE TREADMILL

During the last few months, I have consumed a variety of investment and business discussions through virtual panels. Whether it be an update on commercial real estate in Milwaukee, a discussion on COVID and its impact on the restaurant industry, or simply a community get together of startup founders to break up the monotony of a pandemic, there has been ample time for professional content, educational opportunities, and discovery.

In one of these sessions – one dedicated to the status of venture capital in Milwaukee and Wisconsin, Troy Vosseller – founder of Gener8tor (A startup accelerator based in Wisconsin & ties throughout the country) made an interesting comment.

During the discussion, he was asked about the status quo of the venture capital ecosystem in Wisconsin. And like so many supporters of that space, he was complimentary about the gains we have seen in corporate venture capital participation, startup creation, and investment dollars over the last decade. Over-exuberant positivity and promotion are the names of the game in venture capital and his initial comments were aligned with that convention.

But then he took a turn with his remarks. He stated that despite the nominal gains we have witnessed in Wisconsin entrepreneurial community over the last two decades, everybody needs to appreciate that each startup ecosystem around the country is building, improving, and creating its own degrees of progress.

And to crystalize this idea, he used a treadmill for visualization. He stated, “No matter what we pursue and achieve, the speed we are running at and the incline we are running up can only truly be measured by comparing it to the pace and incline of treadmills around the country.”

WHAT DO THE CHARTS TELL US?

Now keep that treadmill visual in your mind and let’s explore population growth in and around Milwaukee and Wisconsin over time? For this discussion, I have sourced data from the Federal Reserve Bank of St. Louis Fed FRED Economic Database, one of the best free sources of data online.

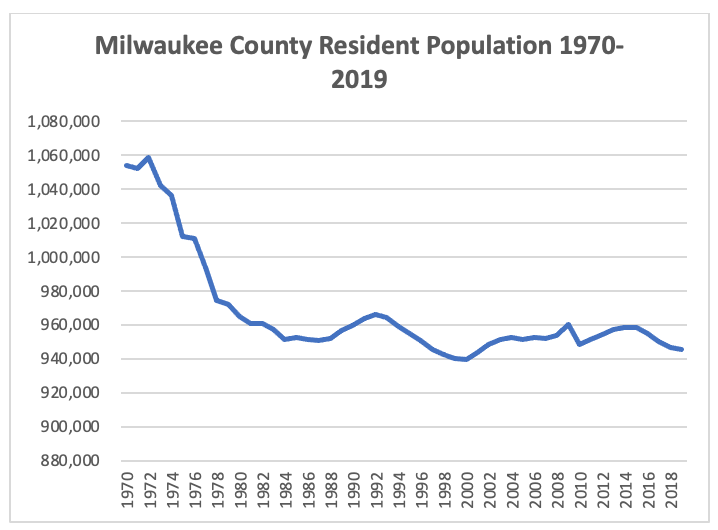

So, what does population look like for Milwaukee County? As you can see, the Milwaukee County population significantly decreased in the 1970s and has languished since.

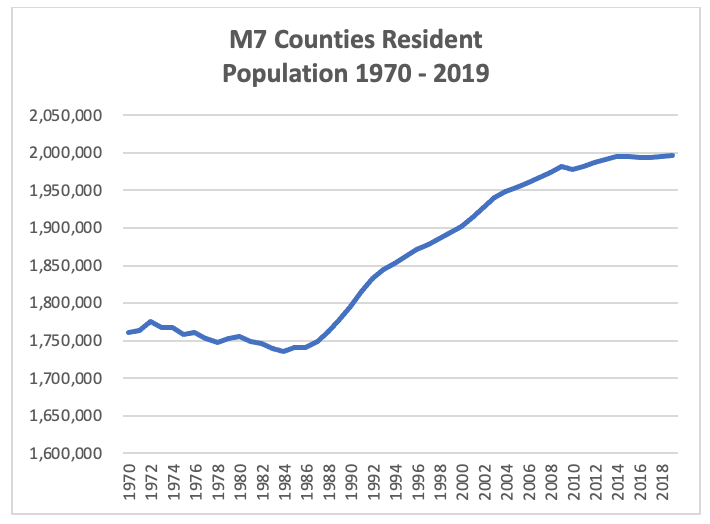

Ah, I can hear the skeptics now…This graph does not account for population migration to the suburbs over the decades. Fair point. Ok, let’s look at the same graph for the M7 Surrounding Milwaukee counties in aggregate (Milwaukee, Racine, Kenosha, Waukesha, Ozaukee, Dodge, Walworth).

Now circle back to Troy’s treadmill. Clearly, population growth in Milwaukee Country has languished. In the greater M7 region it has been tepid at best. However, a critical element of how to think about this growth – our nominal gains (or lack there-of) is to use data that can be compared, “normalized” in a statistical sense.

If we were to consider 1970 data as a base population in each geography – consider the ratios below. They represent how much larger or smaller the population is currently compared to that original level back in 1970.

Milwaukee County – .89x of the base 1970 population

M7 Milwaukee Counties – 1.13x of the base 1970 population

US Total Population – 1.60x of the base 1970 population

Dane County – 1.88x of the base 1970 population

If we are generous and say population growth in Milwaukee is best summarized by the greater M7 region, Madison’s population has grown nearly 7x as fast as Milwaukee. The country’s growth rate is nearly 5x as fast as Milwaukee. Consider this, if Milwaukee County were to have just kept pace on Troy’s treadmill with the country as a whole, the current population today would be 1.69M people in Milwaukee County alone.

Now I could go through the recent decade worth of data and showcase the same kind of examples across the regions. Whether your perspective is across years or decades, the persistent problem of sluggish population is the elephant in the room when we discuss growth as a community.

ATTEMPTING TO CREATE HARMONY WITH BRICKS AND MORTAR

During a few of my conversations over the last couple of years, I would circle back to this lack of population growth and the need for new company formation and job creation. Both factors have been pointed to by academic research as significant factors in economic vitality and growth for communities.

As part of this conceptual idea, I would showcase a current project in Milwaukee as an illustrative example. Most of you are probably aware that the Milwaukee Symphony has nearly completed a multi-year, $140M construction project and fundraising campaign for a new home at the Warner Theater. By itself, it is certainly an accomplishment and will enrich the city with a new experience and a beautiful building. I enjoy classical music, enjoy the experience of going to the auditorium occasionally.

But the question at hand is, “Was a $140M investment in a Symphony Hall made with the tethers of confluence we discussed earlier?” And if we were to continue to be reflective…“Do the trends in the symphony industry suggest such an allocation is opportunistic?” Does Milwaukee exhibit outlier demand curve dynamics which suggest a Symphony Hall is urgently needed by the city?” “Is the Symphony an operational efficient arts organization compared to other music and arts organizations in the community?” “Is the lack of a symphony hall the reason people are not moving to Milwaukee for careers?” “Will a new symphony hall address the well-chronicled racial segregation and inequality issues Milwaukee has struggled with?” These are just a few relevant questions we should pose when considering such a significant investment.

If you look at industry reports (1st link, 2nd link), if you look at the financials of the Milwaukee Symphony, if you simply lean back and consider its impact on the community as a whole, none of the facts would suggest a $140M investment in a Symphony Hall in the city the size of Milwaukee is a strategic investment currently compared to other uses for that capital. “Could it be at some point in the future?”, certainly. If the population were to grow, if our industry and sponsorship base were to broaden, the decision to allocate such a large sum to a single organization would become more justifiable.

During my venture capital fundraising efforts, I would square this choice against one to raise fourteen $10M venture funds that would create 140 companies over the next ten years. Is that possible for a city the size of Milwaukee? It certainly is. And if we assume an eighty percent failure rate in those companies…this investment would yield thirty or so thriving firms full of jobs, people, and wealth that on occasion – might decide to buy symphony tickets and support our rich music and arts community.

My intent is not to be flip, but to showcase that the choices we make with our capital are imperative to the growth that will follow. Would a better choice have been to set up $14M endowments for 10 music and arts organizations in the city and funnel those dollars to the people of those organizations? This alternative would have been a portfolio driven allocation – an investment that was directed at a wider array of fans’ interests across the music and arts disciplines.

Now I’ve used the Symphony Hall as the showcasing example, but over-investment in buildings in Milwaukee is pervasive. There are hundreds of millions of dollars of commercial, hotel, multi-family, and infrastructure real estate projects recently completed, in-construction, and announced within and around the greater Milwaukee area. And if we circle back to the population dynamics currently at play, it is hard to justify such an aggressive investment allocation in new building construction and capacity/square foot expansion. These projects are being fueled by generational low-interest rates, financial engineering, and an insatiable need for annuity-like income by institutional investors.

I hold nothing against the real estate industry and its professionals. I invest in it and appreciate how creative design as to our spaces is a structural asset and tool for the community. But like the decision to build a $140M symphony hall, the choice to concentrate capital allocation into new construction of bricks and mortar projects is not an optimal capital allocation choice at this particular moment. Our community has better options that hold a greater probability of fueling growth in our region.

#INVESTINYOURPEOPLEMILWAUKEE

Like many of you, I use the Twitter platform for education and as a modern-day news wire. I interact with others and share my ideas on it, which you can find @BoldCoastCap. It is simply a national treasure for self-improvement and communication.

As part of this work and identity on Twitter, I have adopted the slogan within it of #InvestInYourPeopleMilwaukee as a rallying cry. When I see a project, an initiative, or an individual that exudes excellence or a person that is attempting to elevate themselves or an idea with robust merit and effort, I have dropped that line as a reminder of the importance and timeliness of investing in people for the greater Milwaukee region.

The community for whatever reason has under-allocated its investment in people and ideas over the last two decades. It has struggled to replenish the necessary wealth and leadership of next-generation businesses and individuals that can take the baton from Milwaukee’s aging boomer generation leaders. It has fallen short competitively versus other regions (treadmills) in supporting intangible projects, ones where more risk, more blind trust, and programmatic investing/betting can and should be utilized to spur individuals to explore the what-ifs of growth and possibility.

So, with that, I strongly encourage you to promote the investment in people and their ambitions within the community and throughout Wisconsin. It is essential, timely, and a decision made with confluence as we attempt to grow the region.

Ross Leinweber

Bold Coast Capital

Part III will explore three opportunities and ideas to invest in and support – ones that can have compounding effects on the community.